I am sharing this since this may not be common knowledge for some: Due to the current high-interest rates, you’ll earn much more on your savings in a money market account compared to a standard savings account.

Examples

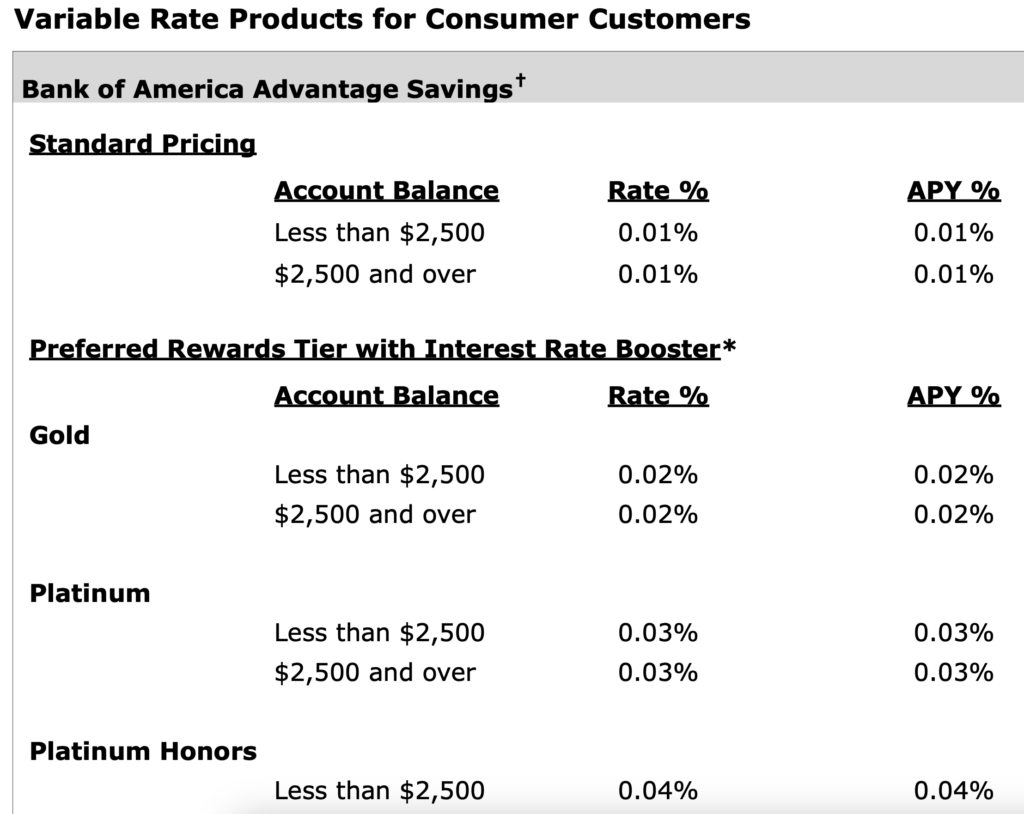

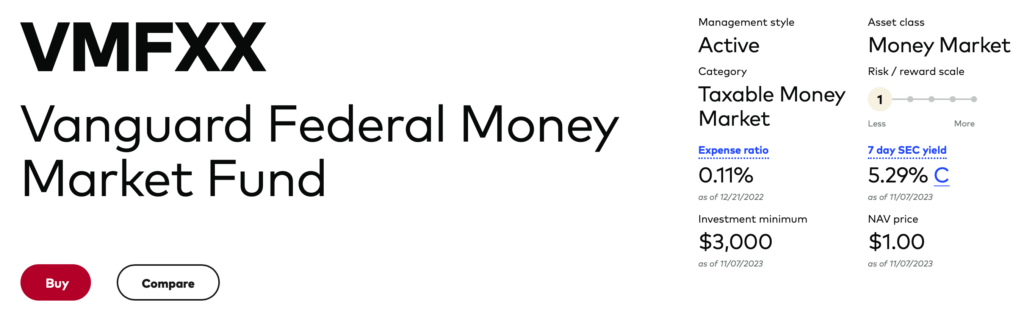

Current Bank of America savings yield is ~0.01%, while for Vanguard’s money market fund (VMFXX) it’s 5.29%.

Bank of America Savings Yield

Vanguard Money Market Yield

Real-life application of where this helps

In late 2023, I bought a new Ford Bronco Wildtrack (4D, MIC). I ordered it a couple years prior (long waitlist) and waited so long that I forgot I ordered it.

Then, one day, I got a call that it was on the lot—quite a large, unexpected expense, as you can imagine.

I knew interest rates were high, but the auto loan interest rate they offered blew my mind: I have a perfect credit score, and the best Ford could do was 8.99% 😱

If I couldn’t find anything better, I was prepared to purchase it in cash, but I called around. I called USAA, and they offered 5.89%. Then, finally, I called Navy Federal, and they offered 4.74%, so I took it and received the check the next day.

So, how does the Money Market help?

First, cash is more valuable when the cost of capital is high, such as in the current interest rate environment.

So, keeping the cash on hand is preferable, if possible. And with a 4.74% interest loan, it certainly was because I earned 5.29% on my money in the Money Market account — a profitable spread (positive arbitrage). It’s been a while, but arbitrage is back again, thanks to high interest rates 😂

How I do it

I use a Vanguard brokerage account and keep my savings in the settlement fund, which can use VMFXX (money market with 5.29% yield).

If I need to draw from my savings, I transfer the funds, which just takes a couple days. So, I keep a bit extra operating cash in my checking account, which is more than offset by the significantly higher interest rate.

And because my cash is in a settlement account and not a fund, I don’t have the typical limitations/minimums that a money market fund has while still getting the yield of a money market fund.

There are other ways to do it (maybe even with higher yields), but I settled on this since I already use Vanguard and it’s fairly simple. The ‘best’ approach will also likely change as the environment evolves (e.g., not long ago HYSAs were a better option), so reevaluate annually.

Other implications

The high risk-free rates also change investment calculus. Other investments must return more to be worthwhile compared to the low interest rates of a couple of years ago (capital is no longer cheap). We haven’t seen rates like this in decades, so we’re still getting used to the implications as our intuitions adjust.